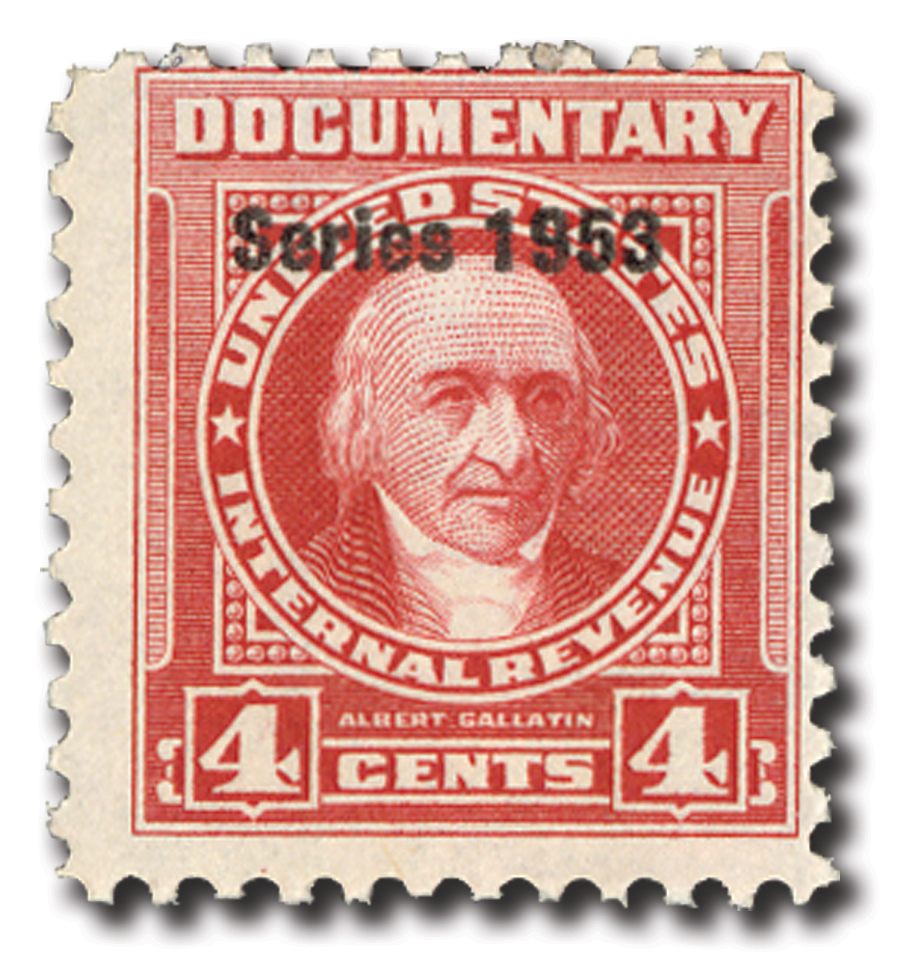

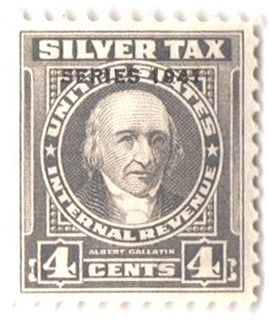

Silver tax stamps were authorized by Congress on June 19, 1934, pursuant to the Silver Purchase Act of 1934.

As a measure to stabilize the US economy and to prevent runs on banks, in the aftermath of the Great Depression, the Gold Standard was abolished in 1933, and all gold bullion and gold coins in private hands were recalled. The government then feared that people... more

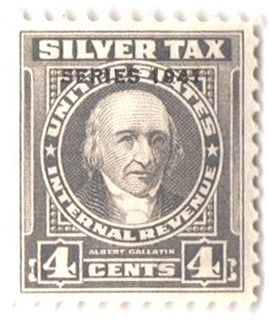

Silver tax stamps were authorized by Congress on June 19, 1934, pursuant to the Silver Purchase Act of 1934.

As a measure to stabilize the US economy and to prevent runs on banks, in the aftermath of the Great Depression, the Gold Standard was abolished in 1933, and all gold bullion and gold coins in private hands were recalled. The government then feared that people would start hoarding silver bullion, causing further runs on US banks.

In order to curb the hoarding of silver bullion, the Silver Purchase Act of 1934 established the Silver Standard, called for the government to establish silver reserves to backup the silver certificate banknotes in circulation, and called for the cessation of the minting of silver dollar coins. The act also imposed a 50% tax on the profit realized on any transfer of silver bullion occurring after May 15, 1934 and provided for the use of silver tax stamps.

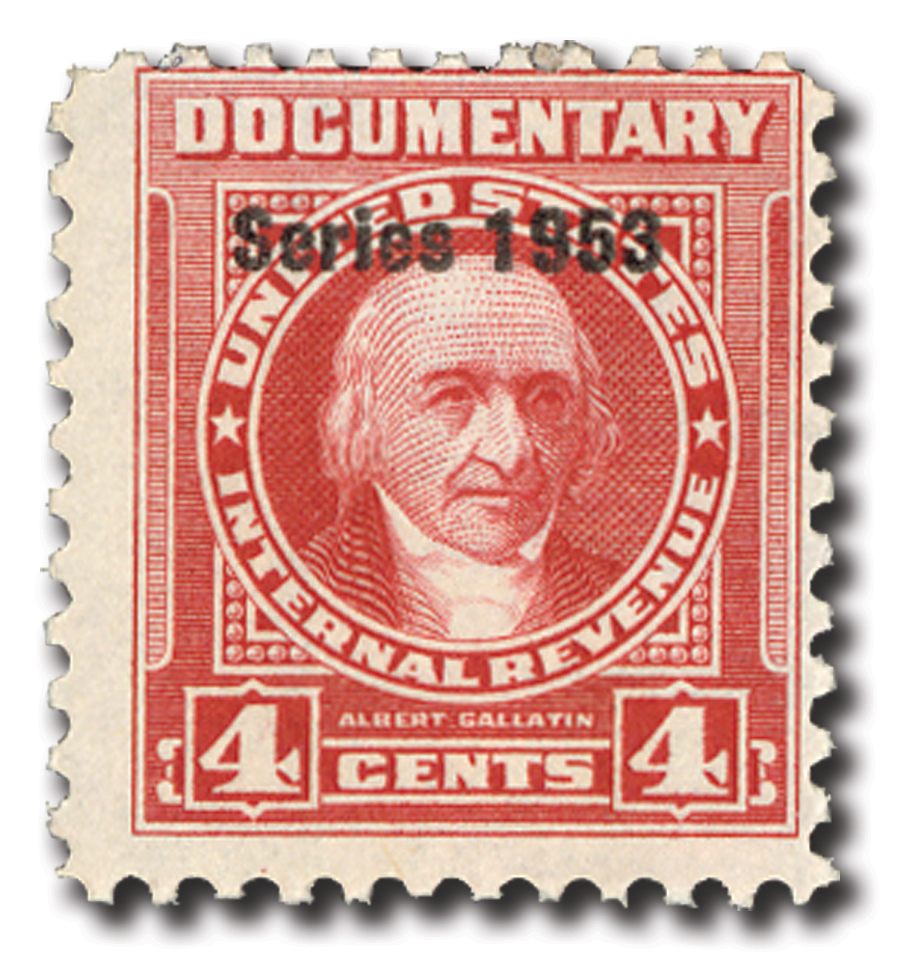

The new silver tax stamps were attached to transfer memorandums, indicating the payment of the federal silver tax. From 1934 to 1940, documentary revenue stamps were overprinted "SILVER TAX". New silver tax stamps were first produced in 1941.

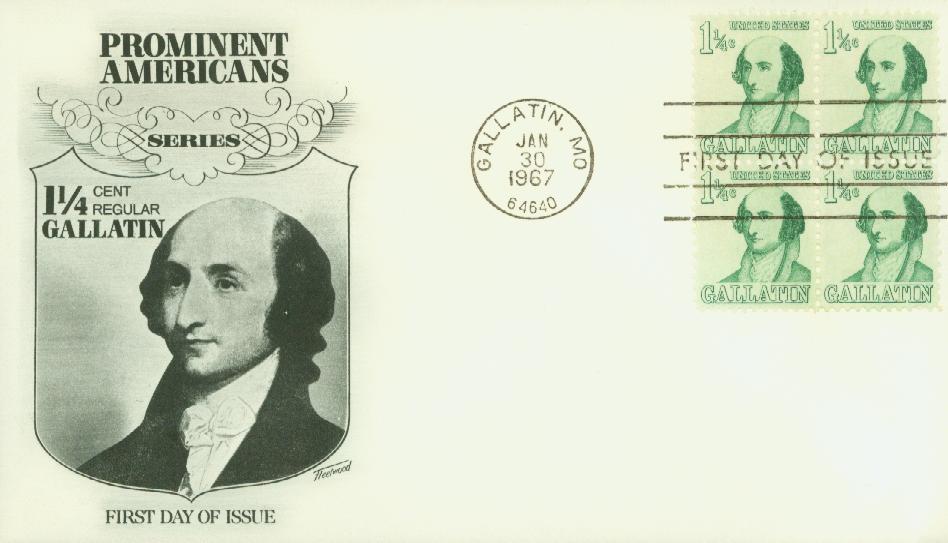

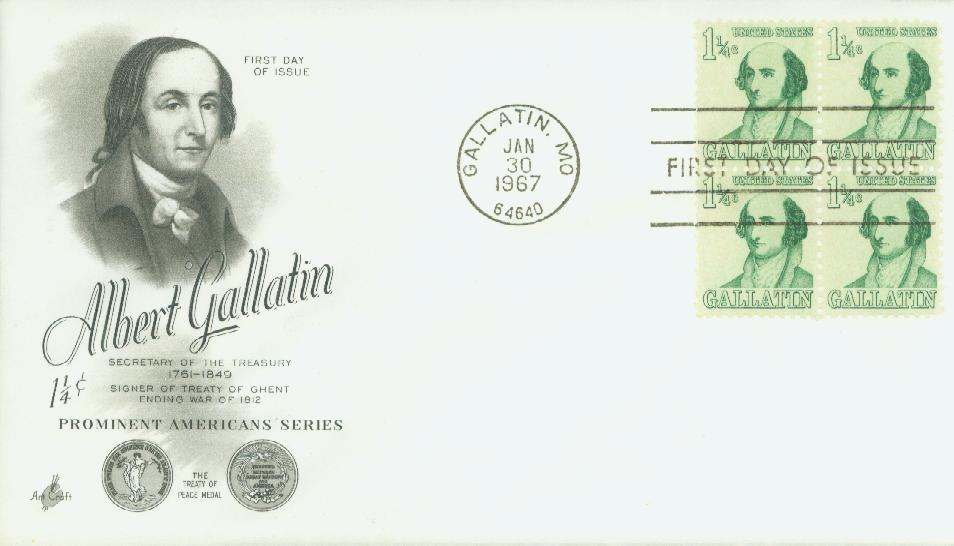

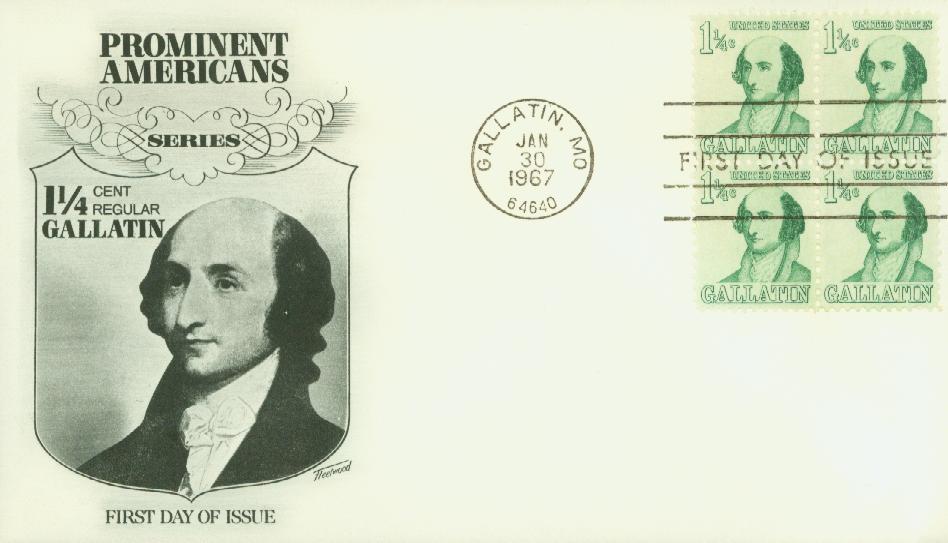

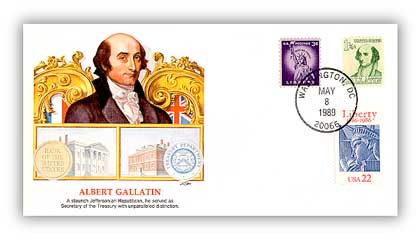

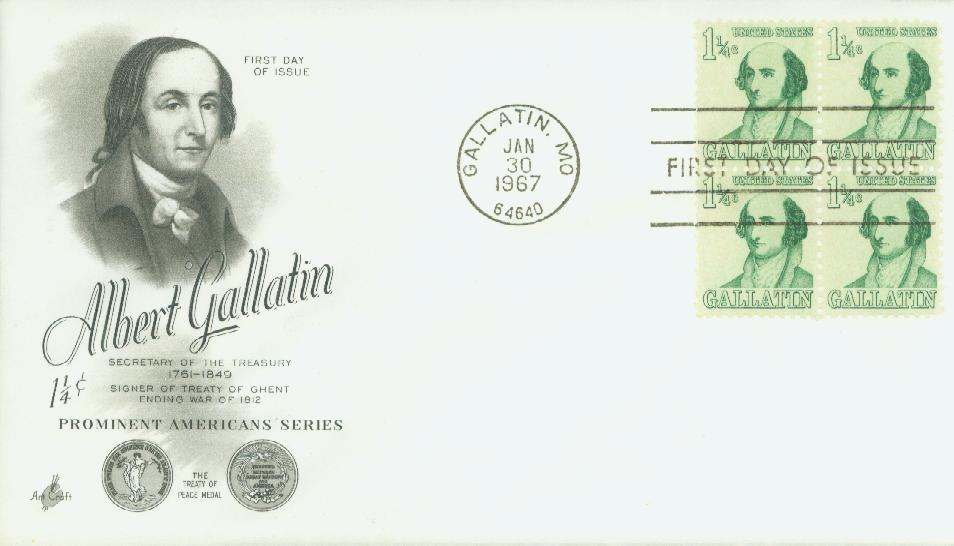

Birth Of Albert Gallatin

Politician and diplomat Abraham Alfonse Albert Gallatin was born on January 29, 1761, in Geneva, Switzerland. Gallatin’s aristocratic family included physicians, statesmen, and soldiers – one of his relatives commanded a battalion at the Battle of Yorktown.Â

After graduating at the top of his class from the Academy of Geneva, Gallatin and a friend secretly set sail for the US in May 1779. Throughout his time in America, Gallatin took part in several business ventures, including the production and sale of glassworks and muskets. He also taught French at Harvard University.

Gallatin began his political career in 1789 as a member of the Pennsylvania state constitutional convention. The following year he was elected to the Pennsylvania General Assembly. In 1793, he was elected to the US Senate. He was removed shortly after due to protests that he’d not been a US citizen for at least nine years, as is required by law to hold that position.

Despite the publicized controversy, Gallatin was elected to the House of Representatives in 1795, later becoming the majority leader. As a leader of the New Democratic-Republican Party, he was the primary spokesman on financial matters and was a founding member of the House Committee on Finance (which later became the Ways and Means Committee).Â

With Thomas Jefferson’s election to president in 1801, Gallatin began a 13-year service as US secretary of the Treasury – the longest service of any person in this position. In this role, he successfully balanced the federal budget and was largely responsible for avoiding a tax increase following the Louisiana Purchase. He also helped map out the Lewis and Clark Exposition. Gallatin was key in resolving the constitutional issues that made this unprecedented purchase quite complicated. And he managed to cut the national debt from $80 million to $45 million.

Â

After resigning from secretary of Treasury, Gallatin led the negotiations at the Treaty of Ghent (ending the War of 1812). He then served as Minister to France and then Great Britain before settling in New York City where he helped found New York University in 1831. He died in New York on August 12, 1849.

Several counties, towns, rivers, and streets are named in Gallatin’s honor as well as the US Department of the Treasury’s highest career service award.

Â