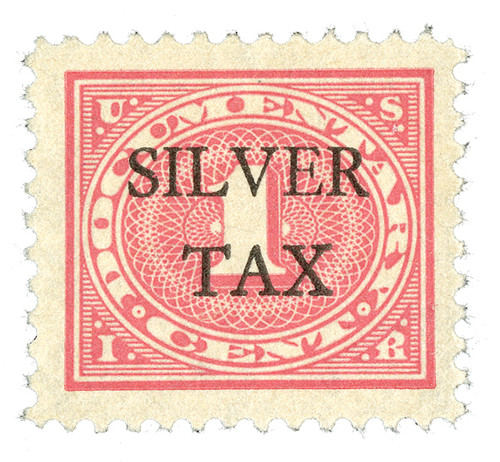

# RG1 - 1934 1¢ Silver Tax, carmine rose, perf 11

Silver Tax Stamps

Founding Father and first Secretary of the Treasury Alexander Hamilton was a supporter of a “bimetallism” money system, in which both gold and silver were used as currency. The two metals would be fixed in relative value. But by the late 1830s, it was clear that bimetallism was a failure, since the market rate of silver was higher than the monetary value of silver.

In the late 19th century, the ratio of gold to silver dropped to an unprecedented level. America was gripped by a post-Civil War depression, and the mine owners of the lightly populated western states were developing a power bloc.

The “Silver Bloc” wanted to bring bimetallism back. They succeeded in getting favorable legislation passed, such as the Sherman Silver Purchase Act of 1890, which required the government to buy 4.5 million ounces of silver a month (as much as the total U.S. production in a full year). President Grover Cleveland repealed the act in 1893.

During the Great Depression, which began in 1929, the value of silver fell dramatically. To help stabilize its value, Congress enacted the Silver Purchase Act on June 19, 1934. The Silver Purchase Act allowed President Franklin Roosevelt to nationalize domestic silver mines. He ordered all U.S. silver to be delivered to the U.S. Mints to be stored or made into coins. The U.S. Treasury paid rates for silver well over its 1934 value, achieving the hoped-for result, raising the price of silver from 45¢ to 81¢ an ounce.

During this time, Roosevelt also purchased large amounts of silver from other countries, increasing the price of silver worldwide. Although most countries were on the gold standard by this time, China still used the silver standard for its currency. The dramatic rise in the price of silver forced the Chinese to abandon the silver standard.

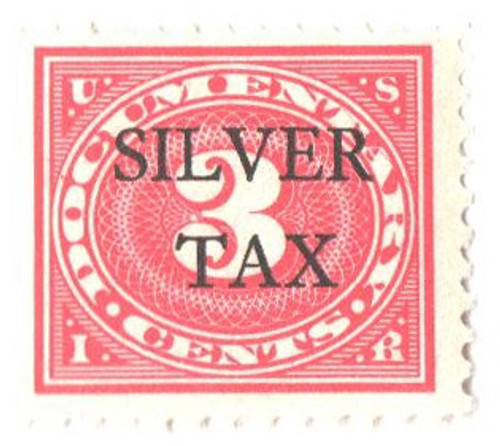

The Silver Purchase Act of 1934 also included a 50¢ tax on profits from the transfer of silver bullion. The tax was paid through Silver Tax Revenue stamps. To document the payment of the tax, the revenue stamps were applied to transfer documents.

The first Silver Tax issues were documentary stamps overprinted with “SILVER TAX.” The denominations ranged from 1¢ to $1,000. Differences in the overprints, such as spacing between the words or ink colors, caused varieties in some denominations.

In 1941, specific Silver Tax stamps picturing secretaries of the Treasury were produced. That year they were overprinted with “SERIES 1941.” The following year, the date was changed on the overprint.

An error occurred on a small number of stamps issued in 1942. The year was replaced with “5942” on one of the 100 stamps on a sheet. About 20 sheets were printed with the wrong number in seven different denominations before the error was discovered. Some of the error sheets already produced were found and destroyed and some were never accounted for.

The overprint was no longer used after 1943. The Silver Tax stamps were discontinued in 1963.

Silver Tax Stamps

Founding Father and first Secretary of the Treasury Alexander Hamilton was a supporter of a “bimetallism” money system, in which both gold and silver were used as currency. The two metals would be fixed in relative value. But by the late 1830s, it was clear that bimetallism was a failure, since the market rate of silver was higher than the monetary value of silver.

In the late 19th century, the ratio of gold to silver dropped to an unprecedented level. America was gripped by a post-Civil War depression, and the mine owners of the lightly populated western states were developing a power bloc.

The “Silver Bloc” wanted to bring bimetallism back. They succeeded in getting favorable legislation passed, such as the Sherman Silver Purchase Act of 1890, which required the government to buy 4.5 million ounces of silver a month (as much as the total U.S. production in a full year). President Grover Cleveland repealed the act in 1893.

During the Great Depression, which began in 1929, the value of silver fell dramatically. To help stabilize its value, Congress enacted the Silver Purchase Act on June 19, 1934. The Silver Purchase Act allowed President Franklin Roosevelt to nationalize domestic silver mines. He ordered all U.S. silver to be delivered to the U.S. Mints to be stored or made into coins. The U.S. Treasury paid rates for silver well over its 1934 value, achieving the hoped-for result, raising the price of silver from 45¢ to 81¢ an ounce.

During this time, Roosevelt also purchased large amounts of silver from other countries, increasing the price of silver worldwide. Although most countries were on the gold standard by this time, China still used the silver standard for its currency. The dramatic rise in the price of silver forced the Chinese to abandon the silver standard.

The Silver Purchase Act of 1934 also included a 50¢ tax on profits from the transfer of silver bullion. The tax was paid through Silver Tax Revenue stamps. To document the payment of the tax, the revenue stamps were applied to transfer documents.

The first Silver Tax issues were documentary stamps overprinted with “SILVER TAX.” The denominations ranged from 1¢ to $1,000. Differences in the overprints, such as spacing between the words or ink colors, caused varieties in some denominations.

In 1941, specific Silver Tax stamps picturing secretaries of the Treasury were produced. That year they were overprinted with “SERIES 1941.” The following year, the date was changed on the overprint.

An error occurred on a small number of stamps issued in 1942. The year was replaced with “5942” on one of the 100 stamps on a sheet. About 20 sheets were printed with the wrong number in seven different denominations before the error was discovered. Some of the error sheets already produced were found and destroyed and some were never accounted for.

The overprint was no longer used after 1943. The Silver Tax stamps were discontinued in 1963.