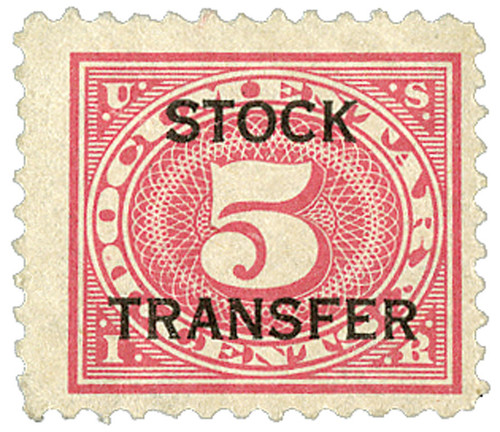

# RD1 - 1918-22 1c Stock Transfer Stamp, carmine rose, horizontal overprint, perf 11

Stock Transfer Stamps- Neat Revenue Stamps, Missing from Many Collections!

Issued to facilitate the collection of a tax on all sales or agreements to sell, or memoranda of sales or delivery of, or transfers of legal title to shares or certificates of stock.

Stock Transfer Stamps

On June 25, 1918, Stock Transfer stamps were approved for use.

As the name suggests, Stock Transfer stamps were used to show that taxes had been paid on the sale or transfer of shares or certificates of stock. A temporary tax has been placed on stock transfers several times since the Civil War. The US placed a .2% tax on the sale or transfer of stocks in the Revenue Act of 1914.

The tax became permanent in 1918. On June 25, 1918, the Treasury Department approved the creation of stamps to show federal taxes had been collected on sales, transfers, and certificates of stock. The Issues of 1918 were US Documentary stamps overprinted with “STOCK TRANSFER.” The Documentary stamps were similar to the Series of 1898 but with the inscription “Series of 1898” removed. To increase security, each high-value stamp was given a unique serial number. The Bureau of Engraving and Printing produced the stamps on double lined watermarked paper.

The lower denominated stamps were carmine overprinted “Stock Transfer” horizontally in red or black ink. The higher denominations were green with vertical overprinting reading from the bottom to the top, though rarer varieties have been found that read the opposite way. These high-values pictured US presidents and were perforated 12.

Government officials feared the higher denominations would be reused, causing the Internal Revenue Service to lose money. As a result, stamps were canceled by cutting or punching small holes in them. As the Great Depression worsened, the tax was doubled to .4% in 1932.

In 1940, Commissioner of Internal Revenue Guy T. Helvering, raised concern over the growing evasion of documentary and stock transfer taxes. He reported that people were reusing Documentary stamps from inactive or discarded files, and even stealing them from documents that had been filed.

To resolve the issue, he recommended that the stamps be overprinted with the year they were issued, making them readily distinguishable from the older stamps. The new stamps also featured the portraits of past secretaries of the Treasury. The lower denominations pictured older secretaries, while higher denominations were more recent. The stamps were issued in booklet panes of four with tabs at their left side. Each had a serial number that corresponds to the one on the tab. Under this new arrangement, if customers bought too many of a year’s stamps, they could exchange them or receive a refund within four years.

The use of stock transfer stamps was discontinued in 1952. By that time there had been more than 370 stock transfer stamps issued over the course of 34 years.

Stock Transfer Stamps- Neat Revenue Stamps, Missing from Many Collections!

Issued to facilitate the collection of a tax on all sales or agreements to sell, or memoranda of sales or delivery of, or transfers of legal title to shares or certificates of stock.

Stock Transfer Stamps

On June 25, 1918, Stock Transfer stamps were approved for use.

As the name suggests, Stock Transfer stamps were used to show that taxes had been paid on the sale or transfer of shares or certificates of stock. A temporary tax has been placed on stock transfers several times since the Civil War. The US placed a .2% tax on the sale or transfer of stocks in the Revenue Act of 1914.

The tax became permanent in 1918. On June 25, 1918, the Treasury Department approved the creation of stamps to show federal taxes had been collected on sales, transfers, and certificates of stock. The Issues of 1918 were US Documentary stamps overprinted with “STOCK TRANSFER.” The Documentary stamps were similar to the Series of 1898 but with the inscription “Series of 1898” removed. To increase security, each high-value stamp was given a unique serial number. The Bureau of Engraving and Printing produced the stamps on double lined watermarked paper.

The lower denominated stamps were carmine overprinted “Stock Transfer” horizontally in red or black ink. The higher denominations were green with vertical overprinting reading from the bottom to the top, though rarer varieties have been found that read the opposite way. These high-values pictured US presidents and were perforated 12.

Government officials feared the higher denominations would be reused, causing the Internal Revenue Service to lose money. As a result, stamps were canceled by cutting or punching small holes in them. As the Great Depression worsened, the tax was doubled to .4% in 1932.

In 1940, Commissioner of Internal Revenue Guy T. Helvering, raised concern over the growing evasion of documentary and stock transfer taxes. He reported that people were reusing Documentary stamps from inactive or discarded files, and even stealing them from documents that had been filed.

To resolve the issue, he recommended that the stamps be overprinted with the year they were issued, making them readily distinguishable from the older stamps. The new stamps also featured the portraits of past secretaries of the Treasury. The lower denominations pictured older secretaries, while higher denominations were more recent. The stamps were issued in booklet panes of four with tabs at their left side. Each had a serial number that corresponds to the one on the tab. Under this new arrangement, if customers bought too many of a year’s stamps, they could exchange them or receive a refund within four years.

The use of stock transfer stamps was discontinued in 1952. By that time there had been more than 370 stock transfer stamps issued over the course of 34 years.