# PS10 - 1940 $1 Postal Savings, gray black, unwatermarked

Â

First Postal Savings Stamps IssuedÂ

Calls for a postal savings bank in the United States date back to 1871. At that time, Postmaster General John A.J. Creswell suggested such a system, similar to the one started in Great Britain in 1861, to help raise money for a postal telegraph network.

No progress was made at that time, but the debate continued for decades. Then in 1907, a Panic made Americans lose faith private banks. In response, president Theodore Roosevelt began promoting the idea of a Postal Savings System to help the everyday depositor and communities that didn’t have banks.

The idea gained support and Roosevelt’s successor, William H. Taft, signed legislation creating the Postal Savings System. Passed on June 25, 1910, the legislation allowed the Post Office Department “to establish postal savings depositories for depositing savings at interest with the security of the Government for repayment thereof, and for other purposes.â€

In December 1910, a few weeks before the system went into operation, Postal Savings Official Mail stamps were issued. The stamps were produced for mail pertaining to the business of the U.S. Postal Savings System. Though the Postal Savings System continued for years to come, the official stamps were discontinued in 1914. Postmasters were instructed to return the unused stamps, which were destroyed.

Under the Congressional Act, the system became effective January 1, 1911, though the depositories didn’t open until January 3, the same day the first stamps were issued. Under this system, the Post Office Department was to redeposit most of the money into local banks, where it would earn 2.5 percent interest. The Postal Savings System then paid two percent interest per year on deposits. The half percent of interest was used to pay for the system’s operation. The minimum deposit was $1 with a maximum of $2,500.

The Postal Savings System was established to serve small investors living in rural communities. Under the program, lower- and middle-income individuals were able to deposit funds at their local post office. Postal Mail stamps, given as proof of the deposit, were redeemable in the form of credits to Postal Savings accounts. While banks were initially against the system, which they viewed as competition, they soon realized it helped to bring a great deal of money “out of hiding from mattresses and cookie jars.â€

The Postal Savings System proved to be very popular among rural Americans, immigrants familiar with similar systems in their native countries, and working people who were unable to conduct transactions during the limited hours of traditional banks. Postal Savings deposits could be made six days per week between the hours of 8 a.m. and 6 p.m. The system eventually extended to over 5,000 post offices in 48 states.

Deposits to the U.S. Postal Savings program grew steadily during World War I and the bank failures of the Great Depression. By 1929, $153 million was on deposit and guaranteed by the U.S. government. That figure grew to $1.2 billion during the next decade and peaked at $3.4 billion in 1947.

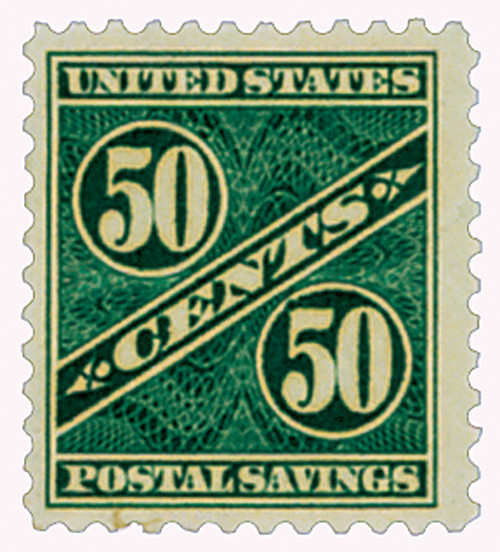

In 1940, four new U.S. Postal Savings stamps were introduced. In addition to a redesigned 10¢ Savings stamp, 25¢, 50¢, and $1.00 denominations were issued. The Postal Savings stamp series featured a bold slanted stripe and each stamp’s denomination was prominently displayed within the vignette or central design.

A second series design change accompanied the 1941 introduction of a $5.00 Postal Savings stamp. The newly designed stamps depicted a Minute Man and the words “America on Guard.†Since the time of the American War of Independence, the Minute Man came to symbolize freedom and liberty, cultural independence, and citizen responsibility. The patriotic theme of the Postal Savings stamps reflected a growing awareness that our nation would soon be drawn into World War II.

Â

Â

First Postal Savings Stamps IssuedÂ

Calls for a postal savings bank in the United States date back to 1871. At that time, Postmaster General John A.J. Creswell suggested such a system, similar to the one started in Great Britain in 1861, to help raise money for a postal telegraph network.

No progress was made at that time, but the debate continued for decades. Then in 1907, a Panic made Americans lose faith private banks. In response, president Theodore Roosevelt began promoting the idea of a Postal Savings System to help the everyday depositor and communities that didn’t have banks.

The idea gained support and Roosevelt’s successor, William H. Taft, signed legislation creating the Postal Savings System. Passed on June 25, 1910, the legislation allowed the Post Office Department “to establish postal savings depositories for depositing savings at interest with the security of the Government for repayment thereof, and for other purposes.â€

In December 1910, a few weeks before the system went into operation, Postal Savings Official Mail stamps were issued. The stamps were produced for mail pertaining to the business of the U.S. Postal Savings System. Though the Postal Savings System continued for years to come, the official stamps were discontinued in 1914. Postmasters were instructed to return the unused stamps, which were destroyed.

Under the Congressional Act, the system became effective January 1, 1911, though the depositories didn’t open until January 3, the same day the first stamps were issued. Under this system, the Post Office Department was to redeposit most of the money into local banks, where it would earn 2.5 percent interest. The Postal Savings System then paid two percent interest per year on deposits. The half percent of interest was used to pay for the system’s operation. The minimum deposit was $1 with a maximum of $2,500.

The Postal Savings System was established to serve small investors living in rural communities. Under the program, lower- and middle-income individuals were able to deposit funds at their local post office. Postal Mail stamps, given as proof of the deposit, were redeemable in the form of credits to Postal Savings accounts. While banks were initially against the system, which they viewed as competition, they soon realized it helped to bring a great deal of money “out of hiding from mattresses and cookie jars.â€

The Postal Savings System proved to be very popular among rural Americans, immigrants familiar with similar systems in their native countries, and working people who were unable to conduct transactions during the limited hours of traditional banks. Postal Savings deposits could be made six days per week between the hours of 8 a.m. and 6 p.m. The system eventually extended to over 5,000 post offices in 48 states.

Deposits to the U.S. Postal Savings program grew steadily during World War I and the bank failures of the Great Depression. By 1929, $153 million was on deposit and guaranteed by the U.S. government. That figure grew to $1.2 billion during the next decade and peaked at $3.4 billion in 1947.

In 1940, four new U.S. Postal Savings stamps were introduced. In addition to a redesigned 10¢ Savings stamp, 25¢, 50¢, and $1.00 denominations were issued. The Postal Savings stamp series featured a bold slanted stripe and each stamp’s denomination was prominently displayed within the vignette or central design.

A second series design change accompanied the 1941 introduction of a $5.00 Postal Savings stamp. The newly designed stamps depicted a Minute Man and the words “America on Guard.†Since the time of the American War of Independence, the Minute Man came to symbolize freedom and liberty, cultural independence, and citizen responsibility. The patriotic theme of the Postal Savings stamps reflected a growing awareness that our nation would soon be drawn into World War II.

Â