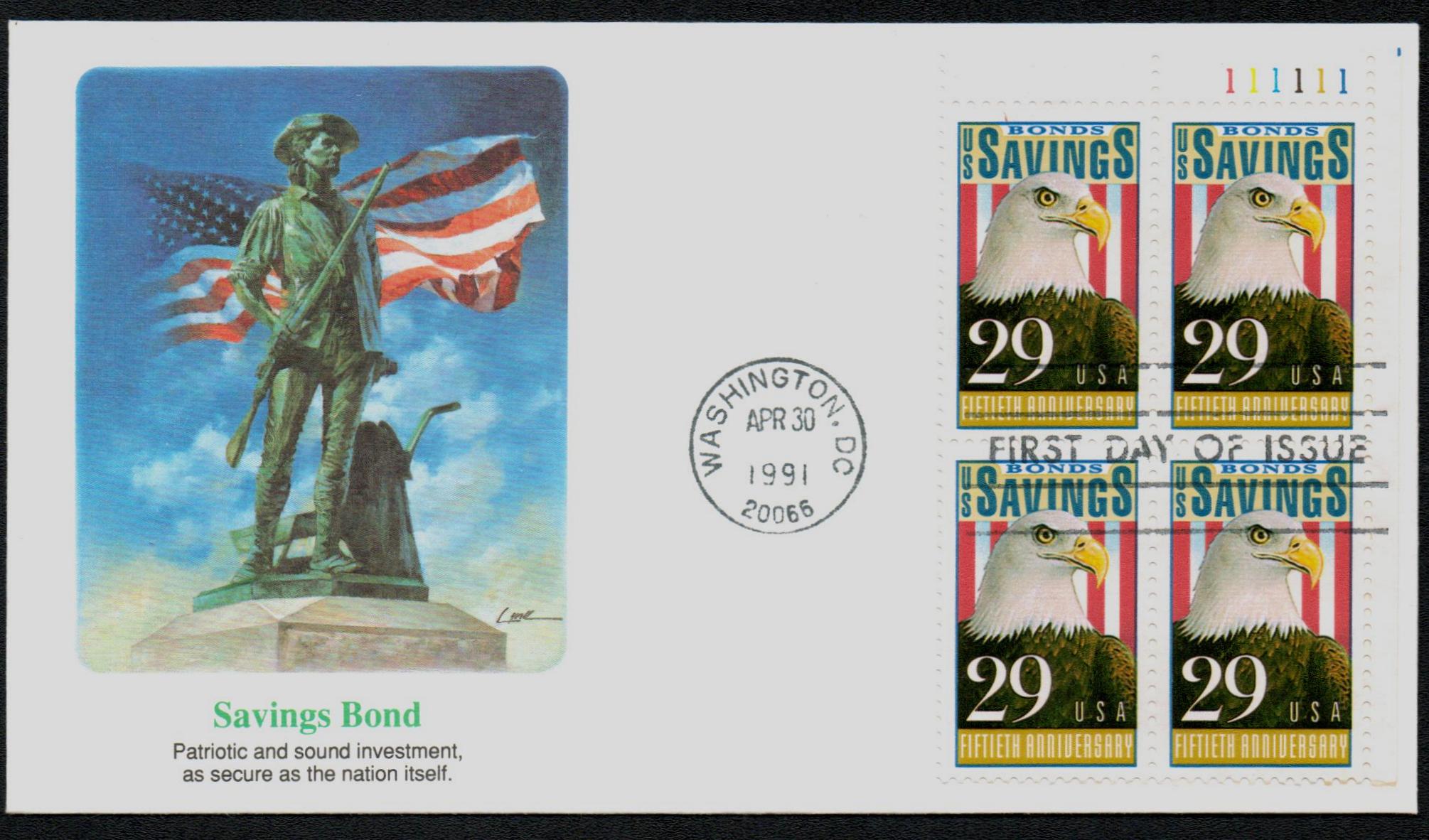

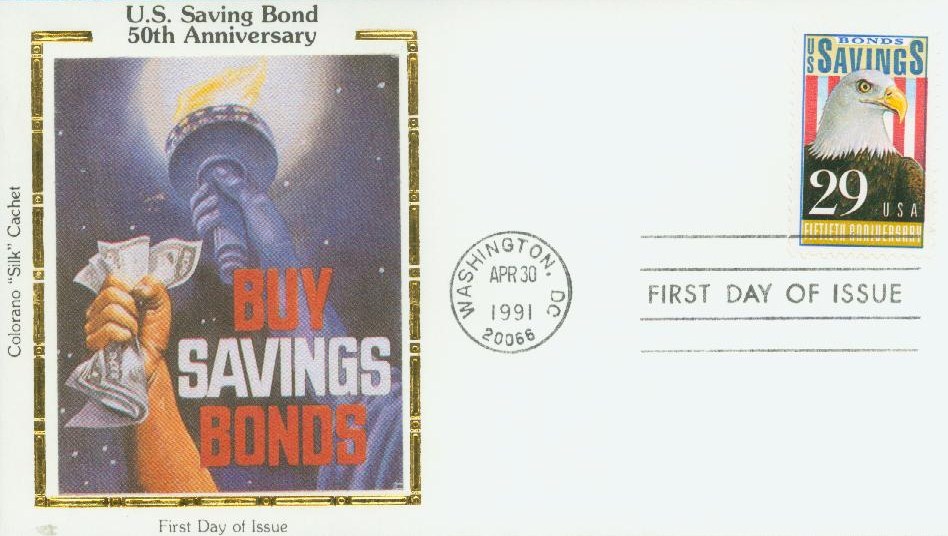

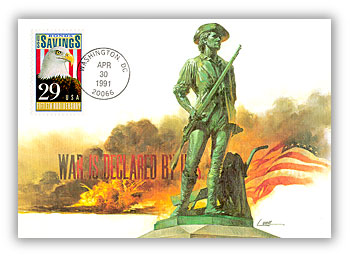

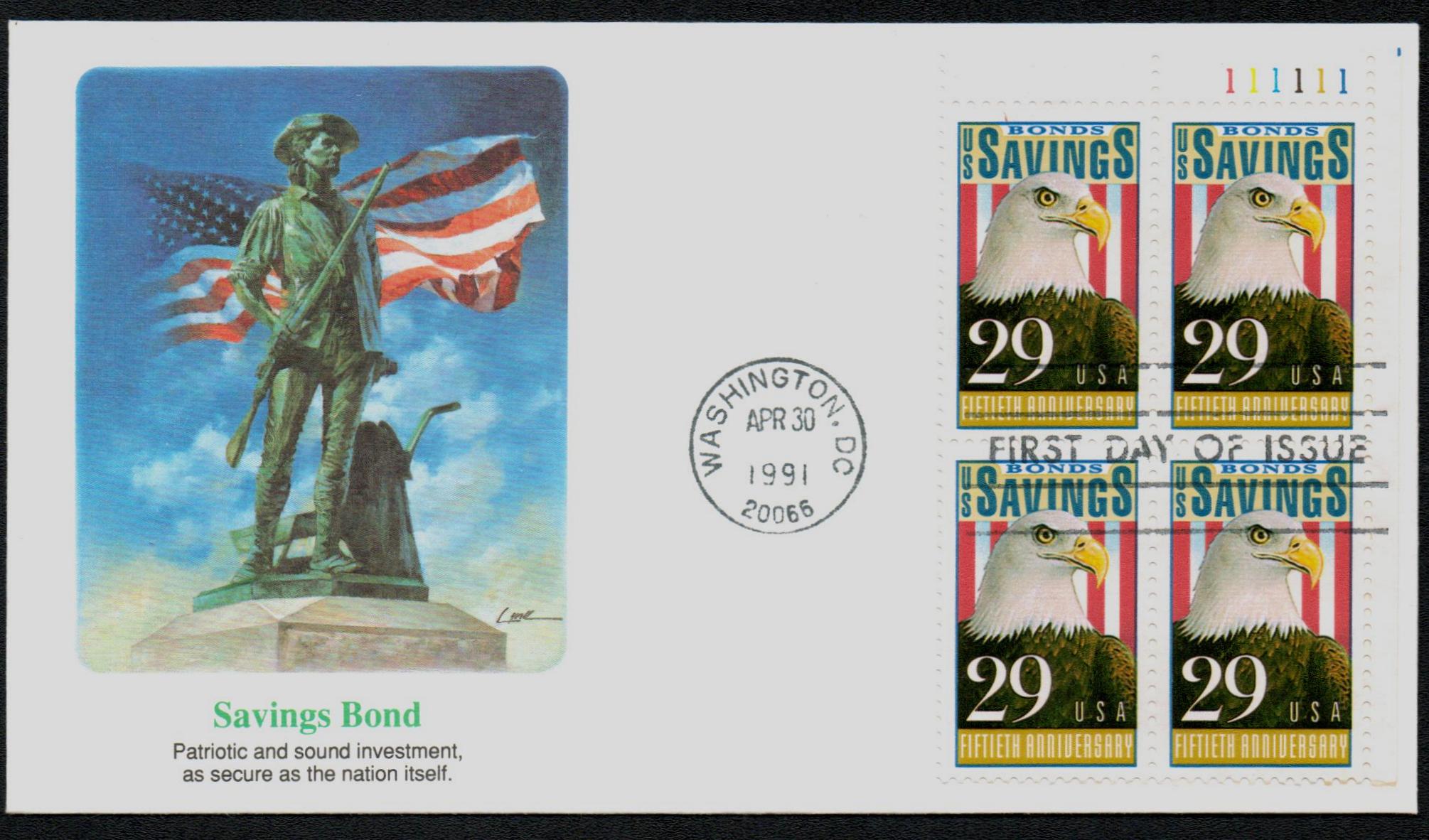

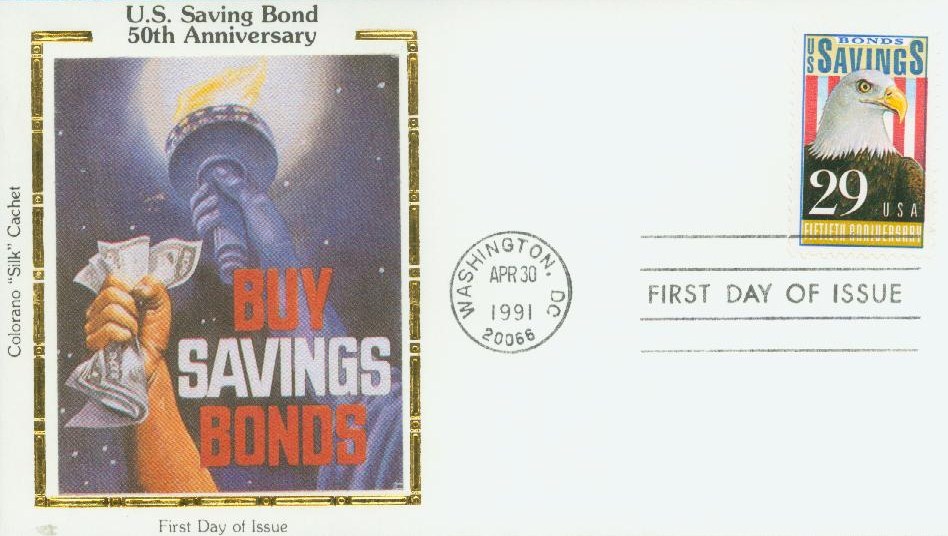

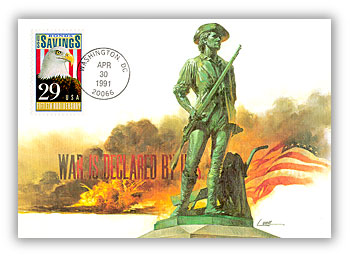

# 2534 FDC - 1991 29c US Savings Bonds

US #2534

1991 US Savings Bonds

- Commemorates 50th anniversary of US Savings Bonds

- Designed to look like World War II bond poster

Category of Stamp: Commemorative

Value: 29¢, First Class mail rate

First Day of Issue: April 30, 1991

First Day City: Washington, DC

Quantity Issued: 150,560,000

Printed by: Bureau of Engraving and Printing

Printing Method: Photogravure

Format: Panes of 50, from printing cylinders of 200 subjects (10 across, 20 down)

Perforations: 11

Reason the stamp was issued: The stamp was issued to honor the 50th anniversary of the World War II-era E Series Savings Bonds.

About the stamp design: Primo Angeli, an advertising designer, used stock graphic images to create the computer-generated stamp art. The Bald eagle has been pictured on a number of US stamps. The stamp was designed to resemble the World War II posters advertising Savings Bonds.

First Day City: The First Day of Issue ceremony was held in the newly renovated Cash Room of the Treasury Building in Washington, DC.

US Savings Bonds

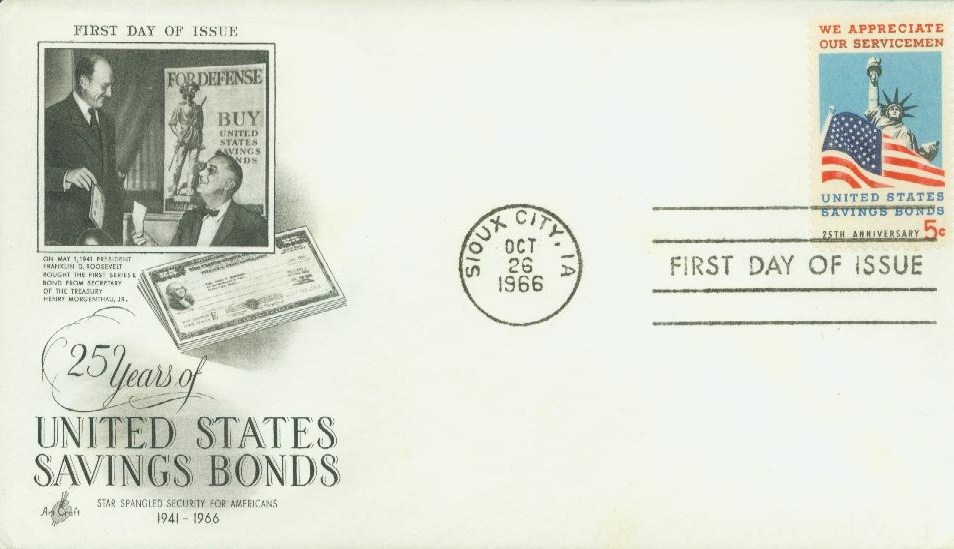

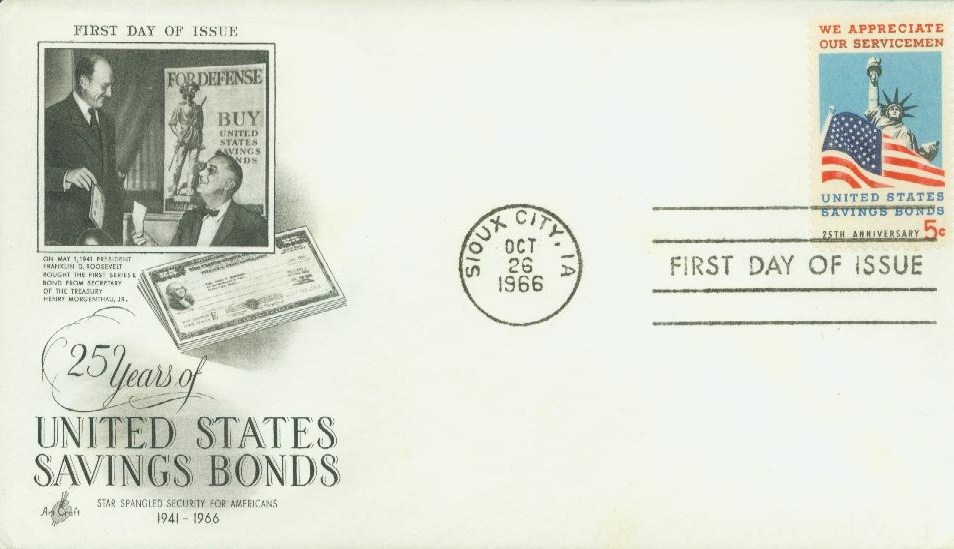

On April 30, 1941, President Franklin Roosevelt announced a new series of US Savings Bonds and bought the first one himself the following day.

The practice of the government selling securities to the public dates back to 1776. That year, private citizens bought more than $27 million in government bonds to help pay for the American Revolution. They put their trust in their new government that they would be repaid. And indeed, they were all repaid, and on time, proving the system worked and paving the way for a new American tradition.

In the years that followed, Americans bought bonds to aid in many other projects: the Louisiana Purchase, the completion of the transcontinental railroad, the Panama Canal, the purchase of Alaska, and most notably, to fund wars. During the Civil War, the government found that selling bonds person-to-person worked very well. And during the Spanish-American War, they found that small-denomination bonds were very popular with the public.

By the mid-1930s, the nation was shaken by the Great Depression, leaving many Americans with little confidence in financial institutions. US Treasury Secretary Henry Morgenthau, Jr. had seen how some programs targeting ordinary citizens had worked well in Great Britain and France and believed a similar program could work in America. He felt that encouraging smaller savers would decrease the dependence on large private investors, while also giving those citizens a more vested interest in national policy. So Morgenthau developed a new type of government security for general financing that would more greatly appeal to the mass market and was specifically tailored to small savers.

By early 1935, legislation was introduced for a new type of security - the US Savings Bond. It passed the House and Senate on February 4, and the first US Savings Bond, Series A, was issued on March 1, 1935. Over the next six years, about 18 million Series A, B, C, and D bonds were sold for a total of about $4 billion.

By early 1941, much of the world was at war and America had begun modernizing its own defenses while providing equipment to our allies. Factories were filled with workers, the public debt was increasing, and price inflation seemed imminent. Secretary Morgenthau, among others, believed that the surplus funds needed to be saved rather than spent, and saw it as an opportunity to unite the public.

So on the night of April 30, 1941, Roosevelt addressed the nation to announce a new Defense Savings Bond, the Series E. He invited all Americans to join him in "one great partnership" to help fund our defense effort. The next day, Roosevelt purchased the first bond as they went on sale to the public. After America entered the war, they became known as War Bonds.

The War Finance Committee supervised the sale of bonds with the help of the War Advertising Council. The posters produced were part of a huge publicity campaign to finance the war. Images of soldiers on the front encouraged citizens back home to sacrifice some their income like the servicemen were sacrificing the comfort of home and even their lives. In addition to the constant reminders from the posters, eight loan drives were held. Some movie theaters offered free admission to anyone who bought a bond that day. The War Bond program was a success as more than $185 billion was raised over the years. Savings Bonds continued to remain popular after the war, and are still offered today.

US #2534

1991 US Savings Bonds

- Commemorates 50th anniversary of US Savings Bonds

- Designed to look like World War II bond poster

Category of Stamp: Commemorative

Value: 29¢, First Class mail rate

First Day of Issue: April 30, 1991

First Day City: Washington, DC

Quantity Issued: 150,560,000

Printed by: Bureau of Engraving and Printing

Printing Method: Photogravure

Format: Panes of 50, from printing cylinders of 200 subjects (10 across, 20 down)

Perforations: 11

Reason the stamp was issued: The stamp was issued to honor the 50th anniversary of the World War II-era E Series Savings Bonds.

About the stamp design: Primo Angeli, an advertising designer, used stock graphic images to create the computer-generated stamp art. The Bald eagle has been pictured on a number of US stamps. The stamp was designed to resemble the World War II posters advertising Savings Bonds.

First Day City: The First Day of Issue ceremony was held in the newly renovated Cash Room of the Treasury Building in Washington, DC.

US Savings Bonds

On April 30, 1941, President Franklin Roosevelt announced a new series of US Savings Bonds and bought the first one himself the following day.

The practice of the government selling securities to the public dates back to 1776. That year, private citizens bought more than $27 million in government bonds to help pay for the American Revolution. They put their trust in their new government that they would be repaid. And indeed, they were all repaid, and on time, proving the system worked and paving the way for a new American tradition.

In the years that followed, Americans bought bonds to aid in many other projects: the Louisiana Purchase, the completion of the transcontinental railroad, the Panama Canal, the purchase of Alaska, and most notably, to fund wars. During the Civil War, the government found that selling bonds person-to-person worked very well. And during the Spanish-American War, they found that small-denomination bonds were very popular with the public.

By the mid-1930s, the nation was shaken by the Great Depression, leaving many Americans with little confidence in financial institutions. US Treasury Secretary Henry Morgenthau, Jr. had seen how some programs targeting ordinary citizens had worked well in Great Britain and France and believed a similar program could work in America. He felt that encouraging smaller savers would decrease the dependence on large private investors, while also giving those citizens a more vested interest in national policy. So Morgenthau developed a new type of government security for general financing that would more greatly appeal to the mass market and was specifically tailored to small savers.

By early 1935, legislation was introduced for a new type of security - the US Savings Bond. It passed the House and Senate on February 4, and the first US Savings Bond, Series A, was issued on March 1, 1935. Over the next six years, about 18 million Series A, B, C, and D bonds were sold for a total of about $4 billion.

By early 1941, much of the world was at war and America had begun modernizing its own defenses while providing equipment to our allies. Factories were filled with workers, the public debt was increasing, and price inflation seemed imminent. Secretary Morgenthau, among others, believed that the surplus funds needed to be saved rather than spent, and saw it as an opportunity to unite the public.

So on the night of April 30, 1941, Roosevelt addressed the nation to announce a new Defense Savings Bond, the Series E. He invited all Americans to join him in "one great partnership" to help fund our defense effort. The next day, Roosevelt purchased the first bond as they went on sale to the public. After America entered the war, they became known as War Bonds.

The War Finance Committee supervised the sale of bonds with the help of the War Advertising Council. The posters produced were part of a huge publicity campaign to finance the war. Images of soldiers on the front encouraged citizens back home to sacrifice some their income like the servicemen were sacrificing the comfort of home and even their lives. In addition to the constant reminders from the posters, eight loan drives were held. Some movie theaters offered free admission to anyone who bought a bond that day. The War Bond program was a success as more than $185 billion was raised over the years. Savings Bonds continued to remain popular after the war, and are still offered today.